Two Sisters. Three Steps. $95/Mo in Savings.

When you work at a bank — even if it’s changing the lightbulbs — people assume you know everything about money. You’re often called upon to calculate the tip at a restaurant or organize the cash in Monopoly, neither of which I’m very good at.

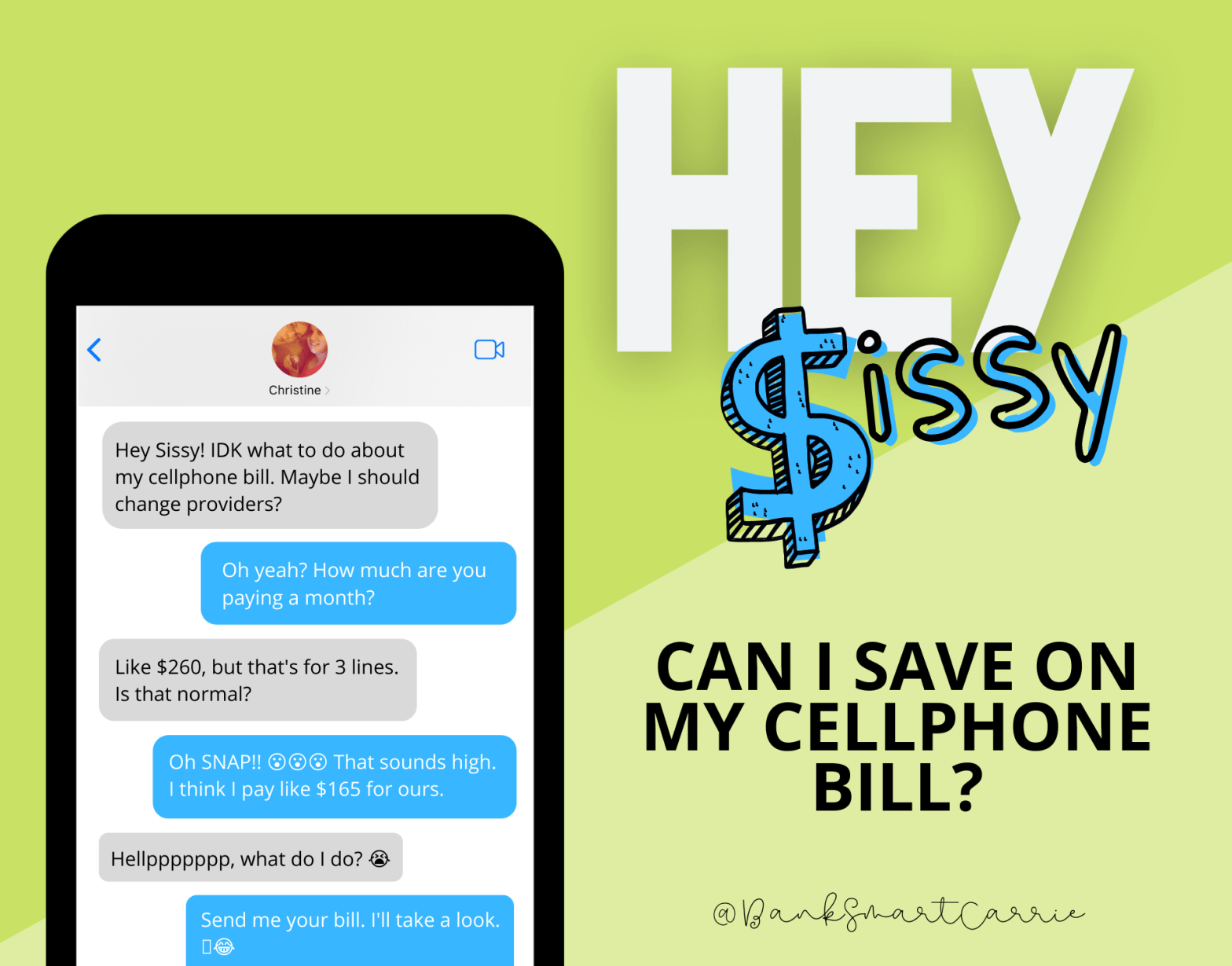

Every so often my sister Christine texts me with a money question. This week’s was especially interesting:

Christine: Hey Sissy! IDK what to do about my cellphone bill. Maybe I should change providers?

Me: Oh yeah? How much are you paying a month?

Christine: Like $260/mo, but that’s for 3 lines. Is that normal?

Me: Oh SNAP!! That sounds high. I think I pay like $165/mo for ours.

Christine: Hellpppppppp, what do I do?

Me: Send me your bill. I’ll take a look.

Now, admittedly, I don’t know much about cell phone plans. I’ve been on the same one since I was 19 and am continuing to savor the unlimited data. But, being a big sister comes with great responsibility. Even if you don’t have all the answers, you boss up and figure it out.

So I start by asking for more information. She sent me her recent bill and some account details to help research further. These next three steps helped me identify $95/Mo in savings!

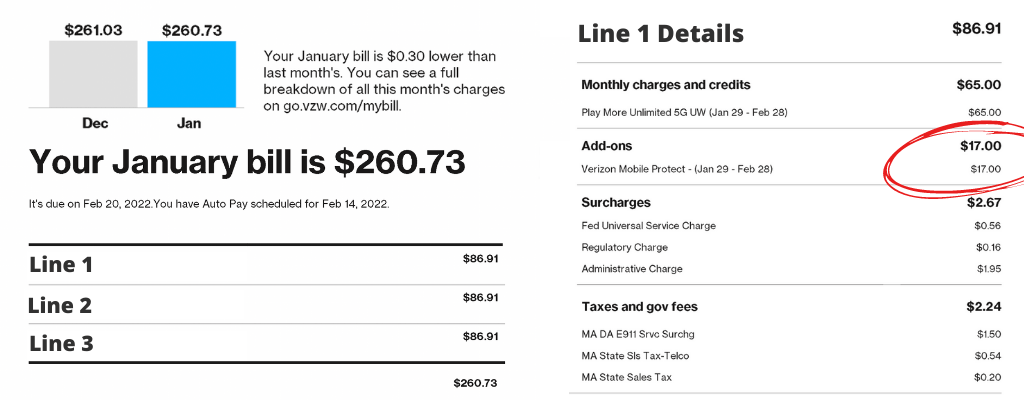

Step 1: Scan the Bill

Here’s a quick snapshot of her previous month’s statement. By now we’re all accustomed to all the small carrier fees and surcharges — the regulatory charge, 911 surcharge, the mobile phone addiction uncharge. Those seem to be the unavoidable evils of having a cell phone plan. (If you know otherwise, please come to the front of the class.)

First, take a look at the monthly base charge. If it seems high, it may be time to explore a new plan or carrier. This depends on your individual needs and usage. In this case, the monthly base plan looks reasonable and in line with other providers. Next, we look for any extras above and beyond the monthly base charge.

Ah-hah! $17/mo add-on for Mobile Protect. This charge appears on all three phone lines, adding up to $51/mo or $612/year.

Mobile Protect is a type of insurance that offers device protection, security and technical support for mobile plan customers. Now whether or not this is worth it could be a whole topic in itself, but there are a few quick bullets that came into play here:

- Do you know what the charge is for? Ummm, phone insurance?

- What does it cover? It is supposed to help if I break my phone.

- Have you used it in the past 90 days? No.

- Do you anticipate using it in the next 90 days? No.

- If you put aside the savings each month would it cover any potential repairs or replacements? Yes.

Let’s recap — If you don’t know what it’s for, what it covers, haven’t used it recently and don’t plan to; it might be a sign you don’t need it. If you’re worried about an unexpected expense, the best thing to do may be to divert that money into your Emergency Fund. By putting aside that extra $17/mo, you’ll create a safety net that can be allocated to something else if needed.

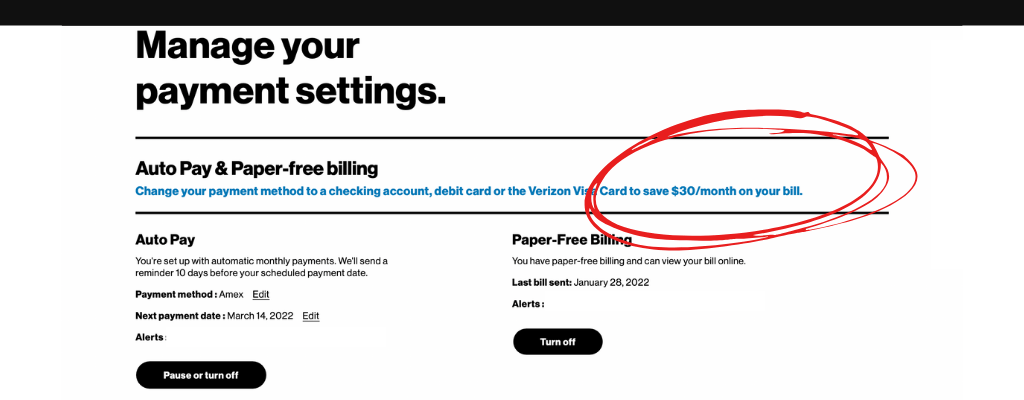

Step 2: Identify Discounts

The best place to start is by looking at the bill and payment settings. Most providers offer a one time or recurring credit for enrolling in electronic statements or auto pay.

In this case, she had already signed up for auto pay and paper-free billing, but they were still offering a discount for updating her payment type. By switching the auto-pay from her credit card to her checking account, we were able to save $10/line/mo, for a total savings of $30/mo and $360/year. (If you’re keeping tally we’re up to a savings of $81/mo and $972/year.)

Here are a few other ways to identify discounts:

- Check with your employer – As employers continue to look for ways to enhance their benefits package, many have partnered with mobile providers to offer a discount on plans and devices. Check with your employer to see if this is something they offer and for instructions for how to enroll.

- Review membership benefits – Consider all the other subscriptions or organizations you belong to. Companies like AAA, AARP and even banks / credit unions may offer promotional codes for a discount on your monthly service.

- Ask live chat – If you have some extra time on your hands, use the live chat on the company’s website or app to ask an agent. Sometimes they are able to offer a recurring or temporary loyalty discount just by asking!

Step 3: Look for Perks

Like employers, cell phone providers look for ways to enhance their product offering and differentiate from the competition. Many are beginning to offer perks and other benefits just for being a mobile plan customer. I discovered this in my search for subscription savings. [Check out the blog here].

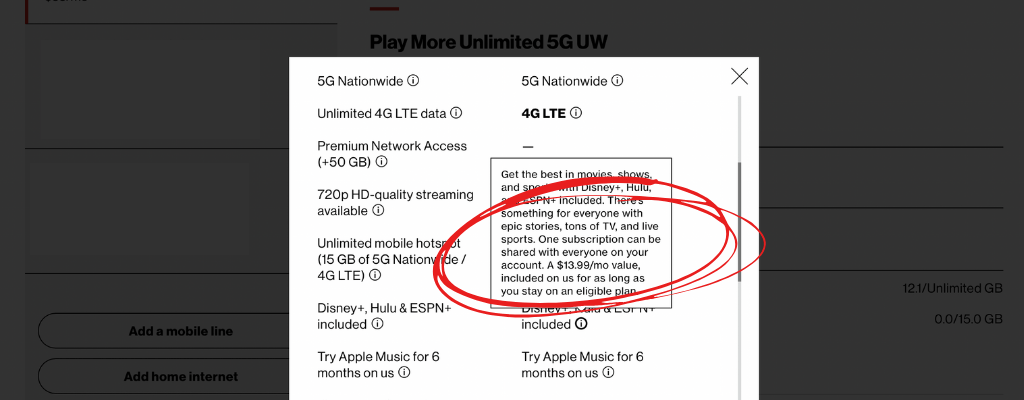

As I combed through the fine print, I find that this particular phone plan comes with a complimentary subscription to the Disney+ bundle, which includes Hulu and ESPN+.

These offers usually apply to both new and existing subscribers. By linking her existing streaming services to her mobile phone plan, we were able to save an additional $13.99/mo or $168/year!

Cha-ching! That brings us to a grand total of $95/mo or $1,140/yr.

That’s a 35% savings!

Guess I can do some math after all…