On my 18th birthday my dad took me to his credit union to open up a checking and a savings account. As a young bright-eyed smartie, getting a checking account was like a right of passage; nearly as important as getting my drivers license.

At the credit union, a basic checking and savings account were the standard menu items offered to all customers. At most financial institutions they still are. Now, I’m a plain pizza, chicken tenders and macaroni and cheese type of girl. Standard menu items are my jam! So, basic is what we went with.

What did I learn that day? Money I make and spend goes in my checking account. Any surplus belongs in my savings account. At the time, those two concepts were the extent of my savings and budgeting knowledge.

That basic lone savings account always felt like a large bucket with a hole in it. Because there was no main purpose or goal, anytime I managed to save up a few hundred dollars, it seemed to drain right out. One time I decided I would use my savings account to set aside money for a house. But, as soon as I managed to save up $600, my car needs new tires. Naturally, I ended up transferring the money out of savings to cover that expense to avoid putting it on my credit card.

It was only recently that I took a more methodical approach to savings. Being a very visual person, it was difficult to picture what the money in that savings account was for. As a result, that balance became ripe for spending.

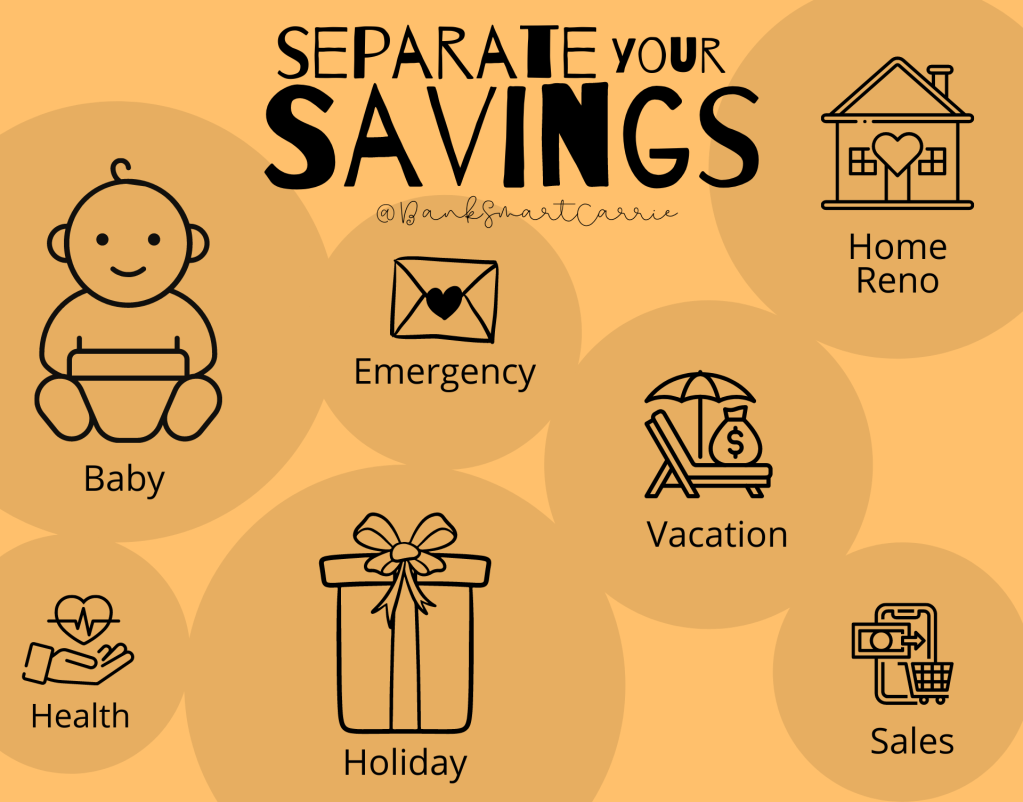

My habits changed drastically when I started opening up savings accounts for each goal. It gave each dollar a home and a purpose. Seeing the money that was allocated towards each goal made it feel more tangible and reduced the risk that I would inadvertently spend it on something else.

Here’s a look at my current savings goal accounts:

- Baby Savings – Bucket for child related expenses. This includes daycare, diapers, clothes, formula, etc. Money saved in this account is in addition to the individual savings accounts I have for each of my little smarties.

- Emergency Savings – Most financial experts recommend saving enough to cover 3 to 6 months of expenses in the event of lost income. Even on a small income, that has always felt like a lofty goal. My ideal emergency savings is anything greater than zero, because any little bit helps to avoid unnecessary credit card debt. Any money allocated in this account will help to offset costs for unexpected expenses that have not been budgeted elsewhere.

- Health Savings – If you have a high deductible healthcare plan (HDHP), there is a special account type that allows you to allocate pre-tax dollars towards eligible medical expenses. I participate in this type of savings plan through my employer, which helps me plan for both short term and long term medical costs. If you don’t participate in an HDHP, you can still choose to set aside money for medical expenses in a basic savings account.

- Holiday Savings– I don’t know about you but winter holidays present the biggest risk for blowing my budget. Thanksgiving is one of our favorite events to host. Preparing a meal and table settings at my house can run upwards of $400. Right after we get our fill of turkey and stuffing, Christmas comes sneaking right around the corner. Celebrations of gifts, food and holiday events can become quite costly. I prioritize these expenses by allocating a direct deposit through my bi-weekly payroll.

- Home Reno Savings – This savings account holds money that is being set aside for home upgrades. Sometimes it is for a specific project, other times I let it accumulate for small updates and hardware store purchases.

- Junk Sale Savings – I affectionately call this account my Side Hustle Sales account. When I started selling random junk around my house through online sites like eBay and Facebook Marketplace, I found that the frequent deposits and withdrawals were clogging my regular spending account. As a result, I opened up a separate savings account to deposit all the online sales. I let money accumulate into this account, then allocate to separate savings goals as needed.

- Vacation Savings – At the beginning of the year, I budget money towards what I want to spend for vacations. Some examples of expenses include: airfare, hotel stays, travel meals, campsite fees, etc. I allocate money each paycheck and also dedicate a portion of online sales in order to meet this goal.

I still maintain a basic savings account that I use for general savings, but feel much more productive with individual accounts. My basic savings is where I allocate money for smaller expenses like:

- Pet Savings – Vet checkups, grooming, dog sitting, collars, leashes, etc.

- Auto Savings – Excise tax, inspection sticker, oil change, car insurance, detailing, etc.

- Donation Savings – Charity donations, sponsorships, etc.

In the future, I may start to break these out into individual accounts as well, especially as I start to think about saving for a new car.

How many savings accounts is too many? Asking for a friend.